By Elizabeth ugbo

Official Market Performance (NAFEM)

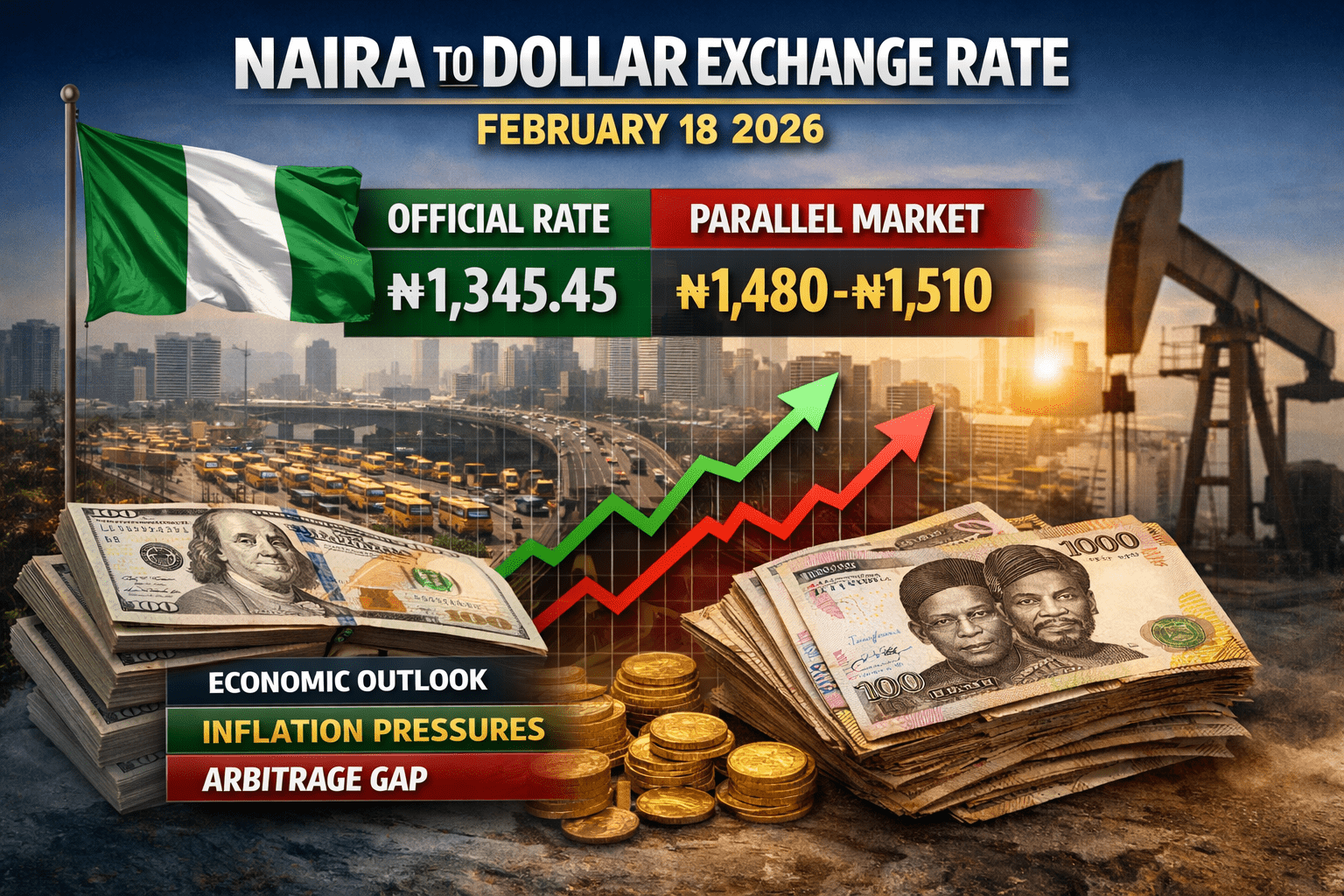

On Wednesday, February 18, 2026, in Nigeria, the Naira traded against the United States Dollar at an average rate of ₦1,345.45 per Dollar in the official market, according to data from the Nigerian Autonomous Foreign Exchange Market.

The rate dipped briefly to ₦1,343.76 during early trading hours. However, it later stabilized at ₦1,345.45 as liquidity improved.

This movement reflects mid-week demand pressures in the Nigerian foreign exchange market. It also highlights continued efforts by the Central Bank of Nigeria to maintain relative stability.

Market analysts attribute this stability to consistent FX interventions and steady export proceeds. As a result, the official window has avoided sharp volatility.

However, intraday high and low margins remain a concern. Corporate buyers continue to hedge against possible afternoon fluctuations.

Parallel Market (Black Market) Trends

Meanwhile, the parallel market shows a wider gap compared to the official window.

In major cities such as Lagos, Abuja, and Kano, Bureau De Change operators report that the Dollar trades at higher rates.

The Dollar is currently bought at ₦1,480. It is sold between ₦1,495 and ₦1,510.

This creates a significant arbitrage gap between both markets. Retail demand largely drives this spread. Many Nigerians seek foreign exchange for school fees, travel allowances, and small-scale imports.

Because these needs often fall outside the official window, pressure builds in the informal market.

Economic Outlook and Market Expectations

The Naira to Dollar Exchange Rate February 18 2026 reflects cautious optimism in the broader economy.

Although the Naira has avoided major devaluation, inflation still affects informal pricing. Traders continue to adjust rates based on supply expectations.

Experts believe steady FX supply through the Nigerian Foreign Exchange Market could ease pressure on the parallel market. If supply remains stable, the arbitrage gap may narrow before the week ends.

For now, businesses and individuals should monitor official channels closely. Accurate pricing remains essential for planning and risk management.

The Naira to Dollar Exchange Rate February 18 2026 continues to shape financial decisions across Nigeria. As liquidity patterns shift, both official and parallel markets will remain under close watch.