By Elizabeth Ugbo

The Canadian Dollar (CAD) maintained stability against the Nigerian Naira (NGN) on Monday, February 16, 2026, in Nigeria’s foreign exchange markets. The resilience comes as the Central Bank of Nigeria (CBN) implements liquidity management strategies, helping stabilize the currency and reduce volatility during trading sessions.

Official Market Trends

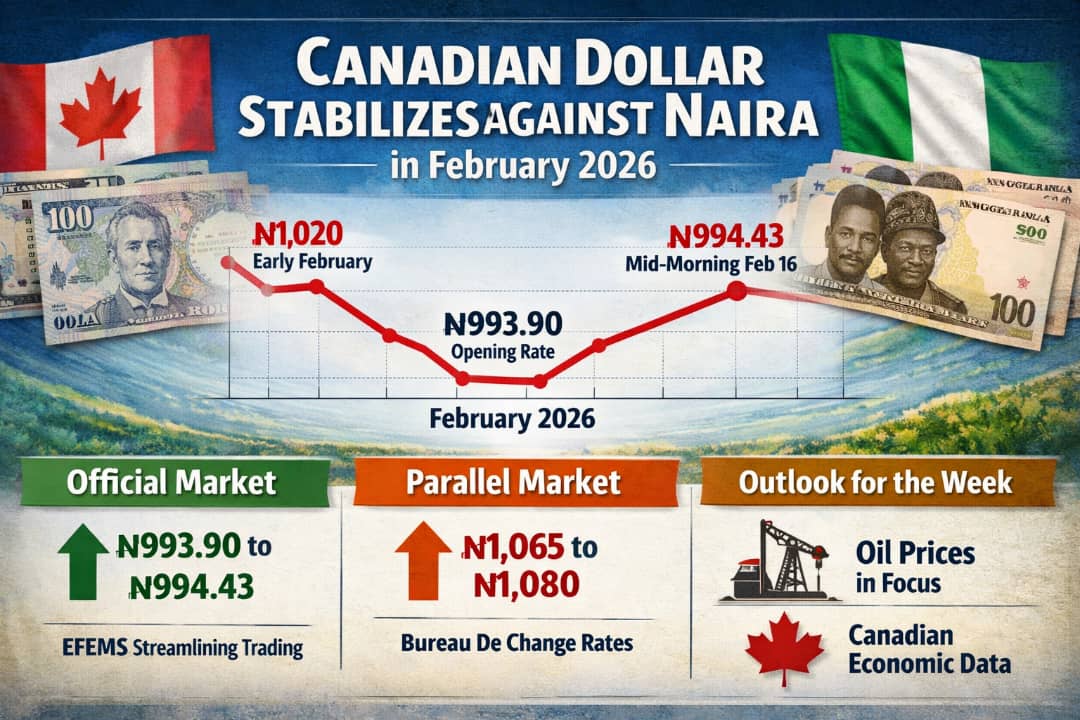

In the Nigerian Foreign Exchange Market (NFEM), the Canadian Dollar opened the trading day at ₦993.90. By mid-morning, the currency experienced a slight rise to ₦994.43, reflecting steady consolidation for the Naira. Over the past two weeks, the CAD retreated from early February highs of ₦1,020, signaling the effectiveness of CBN interventions. Analysts also attribute stability to the Electronic Foreign Exchange Matching System (EFEMS), which has streamlined transactions for importers and minimized typical Monday morning fluctuations.

Parallel Market Performance

In the parallel, or informal, market, the Canadian Dollar continues to trade at a premium over the official rate. In commercial hubs like Lagos, Abuja, and Kano, Bureau De Change operators quote CAD between ₦1,065 and ₦1,080. Traders note that while demand remains strong—driven by education and migration-related transfers—the supply is sufficient to meet retail needs. The narrower gap between official and parallel rates reflects the increasing transparency and availability of foreign currency in official banking channels.

Outlook for the Week

The CAD-NGN pair is expected to remain stable, largely influenced by the Naira’s performance against the US Dollar. With Nigeria’s external reserves steady and ongoing CBN interventions, experts predict little fluctuation for the rest of the week. Investors will be watching global oil prices and Canadian economic data for any potential shifts in exchange rates.